Our team will work with you to find a way to get you engaged in care and keep your out-of-pocket costs as low as possible.

Billing and Insurance

Whether you have private insurance, Indiana Medicaid, Medicare, or even if you are not currently insured, Damien Center wants to work with you to find a way to get you engaged in care and keep your out-of-pocket costs as low as possible. If you need help with obtaining insurance coverage, our Insurance Enrollment Team can assist you in finding the right coverage that meets your needs. Please present your insurance card and photo ID at each visit. Copays, coinsurance, or deductibles may be due at the time of your visit.

Conveniently pay your bill using HealowPay!

If you have questions about a billing statement you received or a general billing question, please submit a Financial Services Inquiry by clicking here.

We accept payment by check, credit card, debit card, and cash (only at the 26 N Arsenal Ave Location). For convenience, you can pay your bill online via your patient portal HERE or at any Damien Center location. We do not accept payment over the phone.

We provide this list as a resource to help you determine whether we accept your specific health insurance plan. This list is not exhaustive. We encourage you to contact your insurance company first if you have any questions about whether your specific health insurance plan will be accepted. You will be responsible for any out-of-pocket costs associated with your insurance plan.

Commercial Plans

- Aetna (PPO)

- Anthem Blue BCBS (PPO)

- Ambetter by MHS

- CareSource

- Cigna (PPO)

- Community Health Direct

- Encore Health Network (PPO)

- Humana (PPO)

- Sagamore

- United Healthcare

Healthy Indiana Plan (HIP)

- Anthem

- CareSource

- MDwise

- MHS

Hoosier Care Connect

- Anthem

- MHS

- United Healthcare

Hoosier Healthwise

- Anthem

- CareSource

- MDwise

- MHS

Medicare Plans

- Aetna Medicare (PPO)

- Anthem MediBlue (PPO)

- AARP Medicare Supplement (United Healthcare)

- Humana Medicare (PPO)

- Medicare Part B

Third Party Administrators

- AIDS Drug Assistance Program (ADAP) - ADAP assists eligible individuals in obtaining limited FDA-approved therapeutic drugs if there is a waiting period before HIAP insurance coverage begins. EIP covers the costs associated with medical services such as doctor visits, laboratory services, specified vaccinations, and influenza shots. EIP provides funding for health care services during a waiting period before HIAP insurance coverage begins.

- Early Intervention Plan (EIP) - This program covers the costs associated with medical services such as doctor visits, laboratory services, specified vaccinations, and influenza shots. EIP provides funding for health care services during a waiting period before HIAP insurance coverage begins.

- Health Insurance Assistance Plan (HIAP) - This program pays the premium, deductible, co-pay and co-insurance costs to eligible individuals routed through participating Indiana Qualified Health Plans.

- PrEP Medication Assistance Program (PrEP MAP) - This program covers office visits, labs, STI treatment, and limited prescription coverage for PrEP-related care.

- Medicare Part D Assistance Plan (MDAP) - This program provides assistance toward the co-pay, co-insurance and deductible cost of a Medicare Part D prescription drug plan for qualifying individuals.

**Please note if you have an Health Maintenance Organization (HMO) plan, we may not be In-Network. Please call your insurance plan to see if your provider is In-Network.

We are Out-of-Network with the following plans:

- Anthem HealthSync

- Anthem High Performance Network (HPN)

- Cigna (EPO)

- IU Health Plans

- Health Maintenance Organizations (HMO)

- Medi-Cal

- Non-Indiana Medicaid plans

Please call the phone number on the back of the card to see if your provider is In-Network.

Co-Insurance. A fixed percentage you are required to pay to receive service. For example, your insurance plan may require you to pay 20% of what your provider charges and your insurance will pay the other 80%.

Co-Pay. A fixed amount you are required to pay to receive service. For example, your insurance plan may require you to pay $25 each time you see a provider and your insurance plan will pay the remaining amount.

Deductible. The amount you are required to pay before your insurance starts paying. Once you reach that amount, then your health insurance may start requiring a co-pay or co-insurance. Please note, many high-deductible plans range from $1,500 to $4,500 per year.

Health Maintenance Organization (HMO). A type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

In-Network Provider. A provider that has contracted with your insurance company to provide its members with discounted healthcare. Your insurance plan determines what you amount you will pay to your provider.

Non-Covered Benefits. Your insurance company will only pay for services that it considers medically necessary. This information is available in your plan handbook. If you receive services that your plan does not cover, you may still be required to pay out of pocket. Please call your insurance company if you are unsure if any services will be covered.

Out-of-Network Provider. A provider that has not contracted with your insurance company to provide its members with discounted healthcare. The amount you pay will always be higher if you see an Out-of-Network Provider.

Out-of-Pocket Maximum. The most you will have to pay annually for services. Once you reach this amount, your health insurance pays 100% of your In-Network costs.

Premium. The amount you pay for your health insurance. If you have health insurance through your employer, this is the amount deducted from your paycheck each month.

Prior Authorization. Your insurance may require you or your provider to get approval before rendering services before you are seen. If you don’t obtain permission, your insurance may not pay for your services and you may still be required to pay out of pocket.

For additional terms and definitions, please visit https://www.healthcare.gov/glossary/

Please see this list for our current chargemaster. Please understand that this is the rate that we charge your insurance carrier. To calculate what your actual cost will be, please contact your insurance company and provide them with the specific CPT code(s) listed on our fee schedule.

We offer financial assistance in the form of a Sliding Fee Scale based on the Federal Poverty Level (FPL). The Sliding Fee Scale may discount your services up to 100%, depending on your qualifying criteria. Please visit our Financial Assistance page for more information and learn how to apply.

Under the No Surprises Act, health care providers need to give patients who don’t have

insurance or who are not using insurance an estimate of the bill for medical services.

You have the right to receive a Good Faith Estimate for the total expected cost of any non-

emergency medical services. This includes related costs like prescription drugs, equipment, and

outpatient fees performed at our health center.

Laboratory testing at Damien Center is conducted by LabCorp. Damien Center is not able to

provide an estimate for these services, but you can visit LabCorp Patient Billing to estimate your

costs.

Make sure your provider gives you a Good Faith Estimate in writing at least 1 business day

before your medical service. You can also ask your health care provider, and any other provider

you choose, for a Good Faith Estimate before you schedule a service or procedure..

You have a right to initiate the patient-provider dispute resolution process if the actual billed

charges from Damien Center are $400 more than the expected charges included in the Good

Faith Estimate you receive before your visit.

You may contact the Damien Center directly to let us know your billed charges were higher that

the Good Faith Estimate. Damien Center will review the actual charges and the Good Faith

Estimate to determine if an adjustment to the charges billed should be made. You can also ask if

there is financial assistance available. Please email us at [email protected].

You may also start a dispute process with the U.S. Department of Health and Human Services

(HHS). If you choose to use this dispute resolution process you must start the dispute process

within 120 calendar days of the date on the original bill. There is a $25.00 fee to use the HHS

dispute process. If the agency reviewing your dispute agrees with you, you will have to pay the

price on this Good Faith Estimate. If the agency disagrees with you and agrees with the health

care provider or facility, you will have to pay the higher amount.

For questions or more information about your right to a Good Faith Estimate, visit

https://www.cms.gov/medical-bi...

https://www.cms.gov/nosurprise...

or call 1.800.985.3059.

Make sure to save a copy or picture of your Good Faith Estimate.

We do not want you to be surprised by a bill, but we must always report to your health

insurance plan the actual services that you received.

If you were seen for a preventative visit visit (i.e. PrEP, physical, annual wellness exam, check-

up, etc.) and a new or ongoing problem is identified and/or discussed with your provider during

the same visit, both services are (preventative visit and office visit) may both be submitted to

your health insurance plan.

Therefore, based on your health insurance plan, they may process your claim for the office visit

with a copayment or apply it to your deductible and you may receive a bill from the health

center.

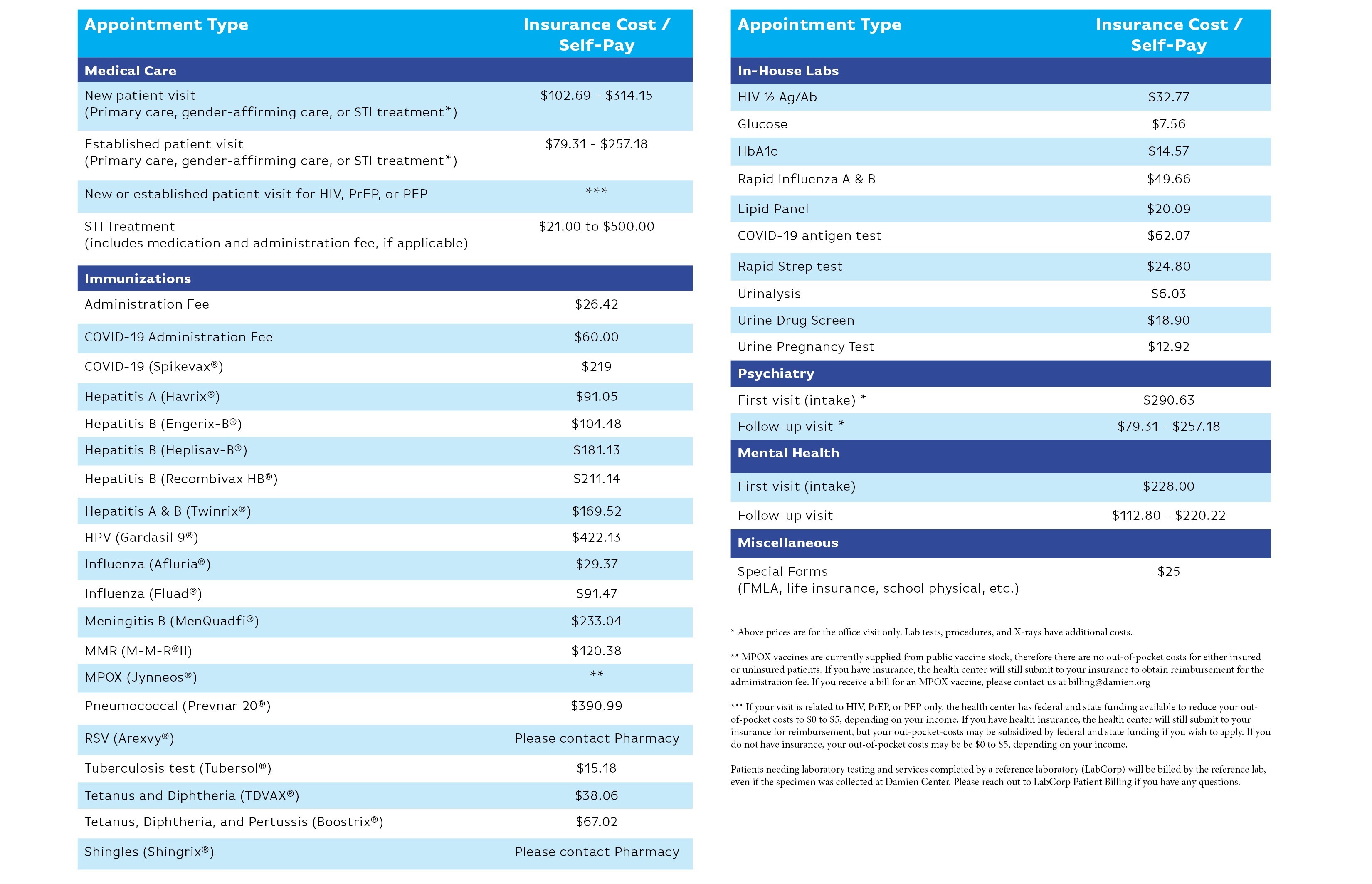

How Much Will it Cost for Care?

Price ranges are listed below for price transparency for common services at the health center. Individual out-of-pocket costs will be dependent on your insurance carrier. Please note that for some services, including those not listed, charges may vary based on the treatment you need.

If you have health insurance, these are the charges billed to your insurer. Your out-of-pocket cost is determined by your health insurance plan. These could include deductible, co-insurance, or co-pay. Please review the information on your card, Summary of Benefits & Coverage, or call the phone number on the back of your insurance card. These costs are estimates only.

If you do NOT have health insurance, you may be eligible for the sliding fee scale which reduces your amount out-of-pocket cost. Please visit our Financial Assistance page to learn more and apply. You can also meet with one our Patient Financial Counselors to discuss your options.

Need a copy of this chart? Download Care Cost Chart.

Need a copy of this rate chart with insurance billing codes? Download Care Cost with Insurance Codes.